Investment Demand

- Investment - $ spent/expenditures on new plants/factories, capital equipment, technology, new homes, inventory.

Expected Rates of Return

- Invest based on cost/benefit analysis

- Benefits from expected rate of return

- Cost from interest costs

- Amount of investment from comparison of expected rate of return to interest cost

- Exp return > Interest Cost = Yes

- Exp return < Interest Cost = No

- r% vs. i%

- Nominal = observable rate of interest; Real takes out inflation, known ex post facto

- r% = i% - pi% -> bases investment decision

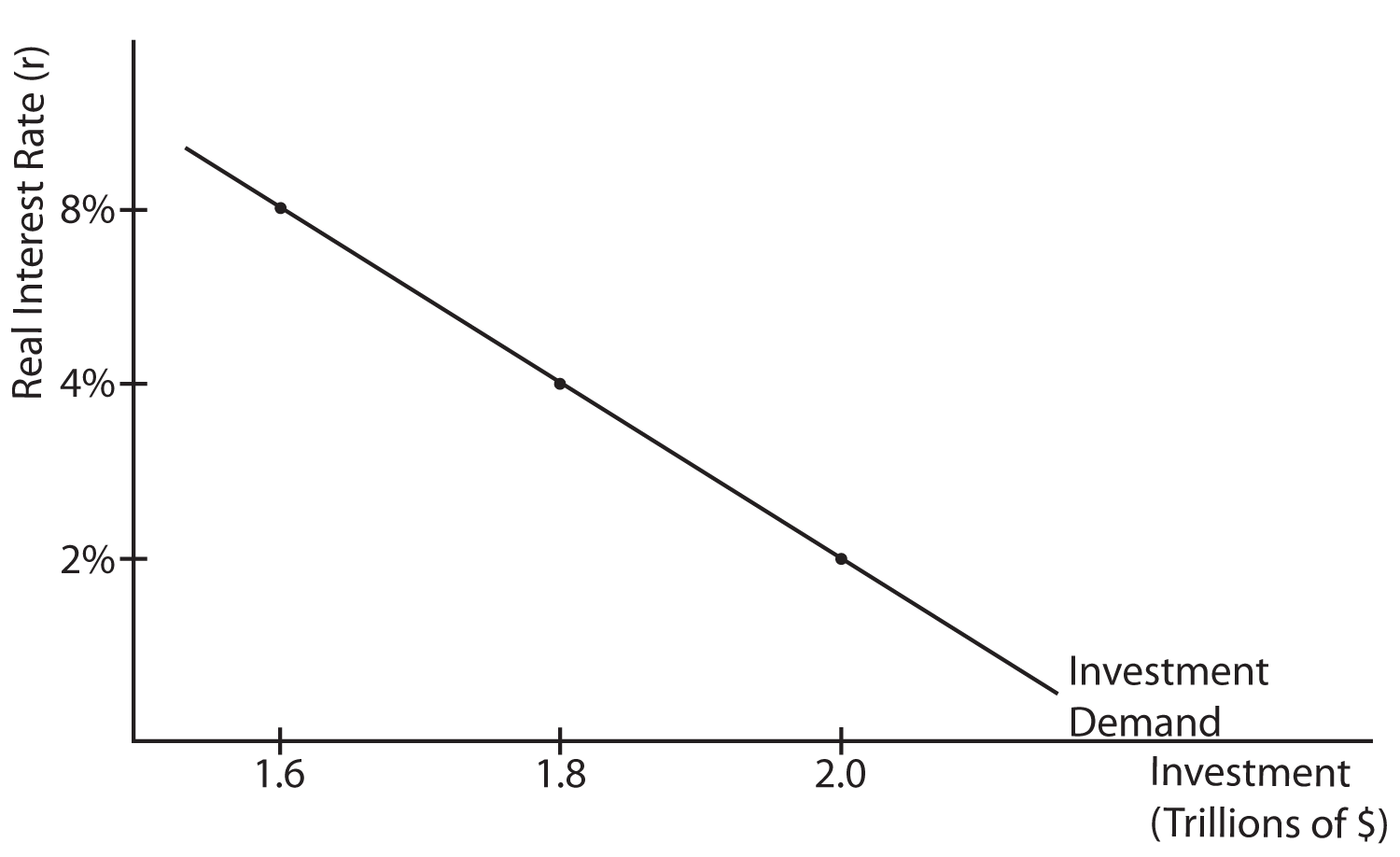

The Curve

- Downward sloping because high rates = less investment, vice versa

- Shifts

- Cost of production

- Business Taxes

- Tech Change

- New = right

- Lacking = Left

- Stock of Capital

- Expextations

- Positive = right

- Negative = left

No comments:

Post a Comment