Conducted by the FED; comprised of 3 tools

Reserve Requirement

- Small % of deposit in bank, rest is loaned out (Fractional Reserve Banking)

- Inc. in MS -> Inc. in amt of $ held in bank deposits

- Recession - Dec. RR -> More ER; More loans; MS up, interest rates down; AD up (Easy)

- Inflation - Inc. RR -> Less ER; Less loans; MS down, interest rates up; AD down (Tight)

Discount Rate

- Interest rate FED charges to banks

- MS up needs decrease in Dis. Rate (Easy)

- MS down needs increase in Dis. Rate (Tight)

Open Market Op

- FED buys/sells bonds (securities)

- MS up needs buy bonds (easy)

- MS down needs sell bonds (tight)

Easy monetary policy: Buy Bonds; Decrease Dis. R & RR

Loans increase; AD up; GDP up; MS up; Interest rates down

Tight monetary policy: Sell Bonds; Increase Dis. R & RR

Loans decrease; AD down; GDP down; MS down; Interest rates up

- Fed Fund Rate - FDIC banks loan each other overnight funds (Opposite of Dis. Rate)

- Prime Rate - Interest rate banks give to most credit worthy customers

Countercyclical Policies: Keynesian Fiscal Policy vs. Monetary Policy

In the early 21st century, here in the USA, an efficient, "full employment" economy will probably have:

- Annual unemployment rate 4%

- Annual inflation rate 4%

If the economy goes into a recession:

- The real GDP drops for at least 6 months

- Unemployment rate increases to 6% or more

- Inflation rate decreases to 2% or less

If Congress enacts Keynesian Fiscal Policies to attempt to slow/stop the recession, then:

- The policy will try to improve C or G (parts of AD)

- Congress will decrease federal taxes

- Congress will increase job and spending programs

- The federal budget will probably create a deficit

- Due to changes in Money Demand, interest rates will increase (Crowding out might occur, but Keynesians don't care)

If the Federal Reserve employs Monetary Policy options to slow/stop the recession, then:

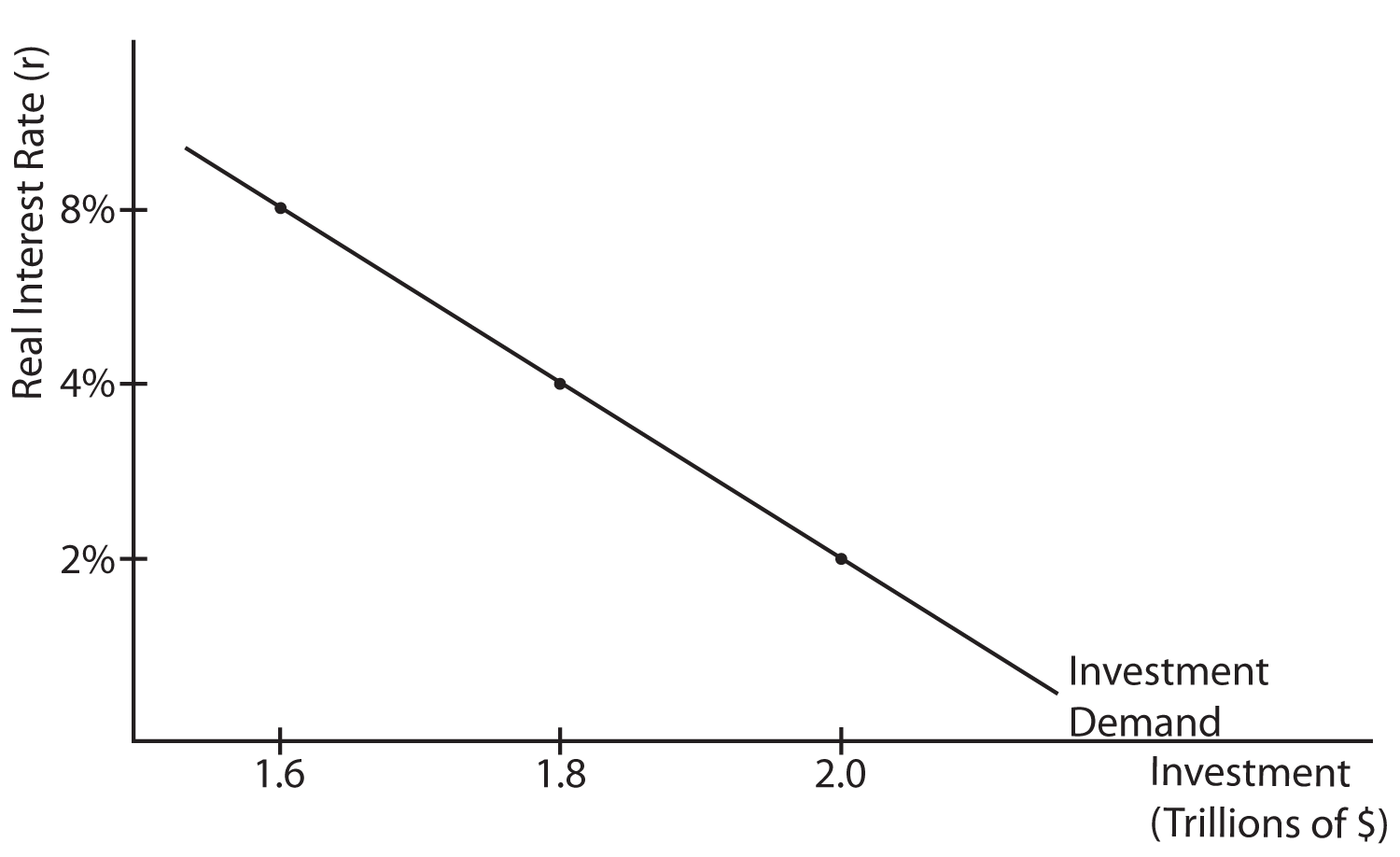

- The policy will target improvement in Ig (part of AD)

- The Fed will target a lower Fed Fund Rate

- The Fed can lower the discount rate

- The Fed can buy bonds (Open Market Operations)

- The Fed can (theoretically) lower the reserve requirement, but probably won't because it is too complex for the banks.

- These Fed policies will lower the interest rates through changes in the Money Supply

- These options should increase Ig

If the economy suffers from too much demand-pull inflation or cost-push inflation, then:

- The unemployment rate will go to 4% or less

- The inflation rate will probably go to 4% or more

If Congress enacts Keynesian Fiscal Policies to attempt to slow/stop the inflation problems, then:

- The policy will try to decrease C or G (parts ofAD)

- Congress will increase federal taxes

- Congress will decrease job and spending programs

- The federal budget will probably create a surplus

- Due to changes in Money Demand, interest rates will decrease

If the Federal Reserve employs Monetary Policy options to slow/stop the inflation problems, then:

- The policy will target decreases in Ig (part of AD)

- The Fed will target a higher Fed Fund Rate

- The Fed can increase the discount rate

- The Fed can sell bonds (Open Market Operations)

- The Fed can (theoretically) raise the reserve requirement, but probably won't because it is too complex for banks

- These Fed policies will raise the interest rates through changes in the Money Supply

- These options should decrease Ig

.jpg/138778625/Foreign_Exchange_Market_(Supply_Shifts).jpg)